Yongan hang, two hydrogen bikes?

Text: Poetry and ID:SingingUnderStars (Yongan) WeChat official account of the “public”, in December 22nd, Yongan in Jiangsu Changzhou officially put into operation “hydrogen bicycle system” and 1000 hydrogen vehicles.

The bicycle has a hydrogen energy endurance of about 70 kilometers, a maximum speed of 23 kilometers per hour and manual hydrogen exchange in 5 seconds.

This hydrogen bicycle is reformed from the structure of ordinary bicycle, and the principle is not complicated.

The hydrogen storage tank adopts metal hydrogen storage technology, which is safe and reliable.

The whole process is OK, so what’s the problem? Cost.

The cost of a hydrogen bicycle is about 20000 yuan, and the price of 2 yuan for 20 minutes is no different from giving it away for free.

The cost of a hydrogenation station is also in the millions or even tens of millions.

The company invested tens of millions to build 1000 hydrogen energy bicycles that can’t return their capital.

What’s the picture? In 2021, the market value of Yongan bank increased by almost 58%.

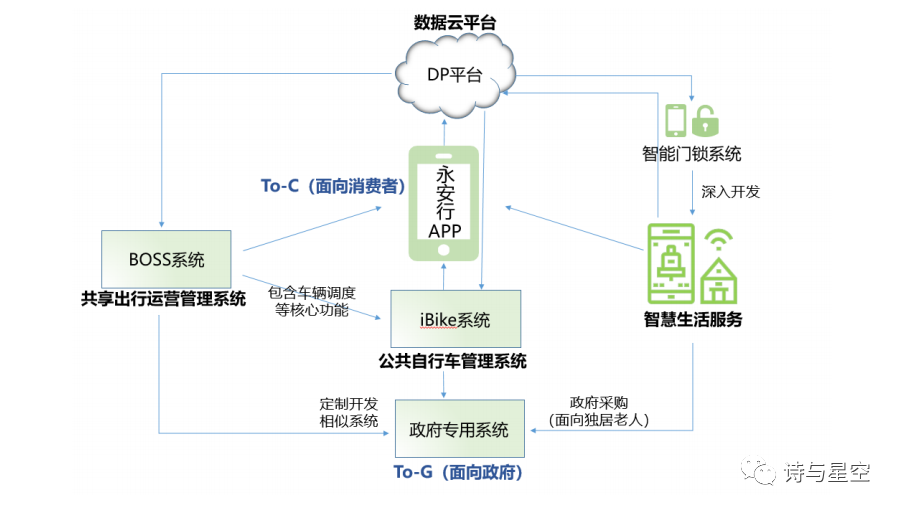

0 # 1 # the real business of Yongan bank what does Yongan bank do? As a well-known listed company, we all know that it is engaged in bike sharing.

XingKong Jun thought so, until he opened its financial report and fell into meditation.

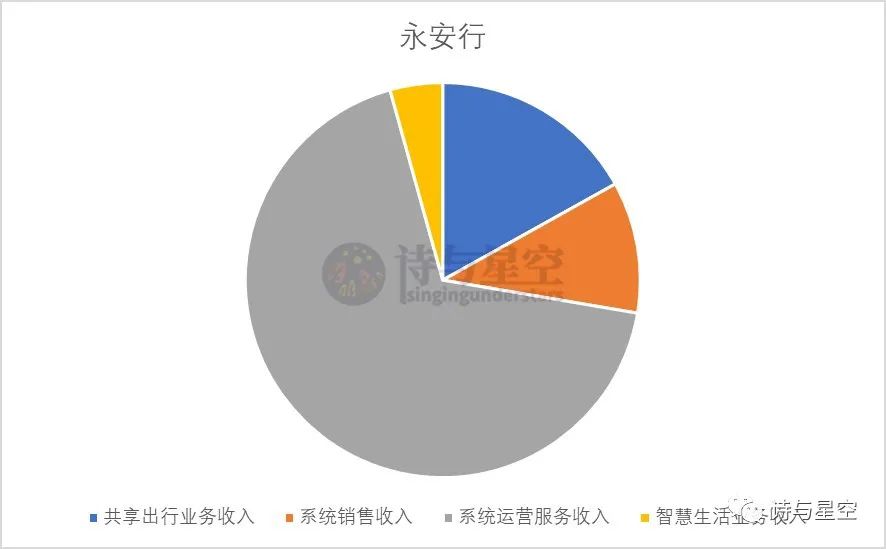

Data source: flush Ifind, drawing: according to the 2020 annual report of poetry and starry sky, more than 60% of the company’s revenue comes from “system operation service revenue”, while the share of shared travel business is very low.

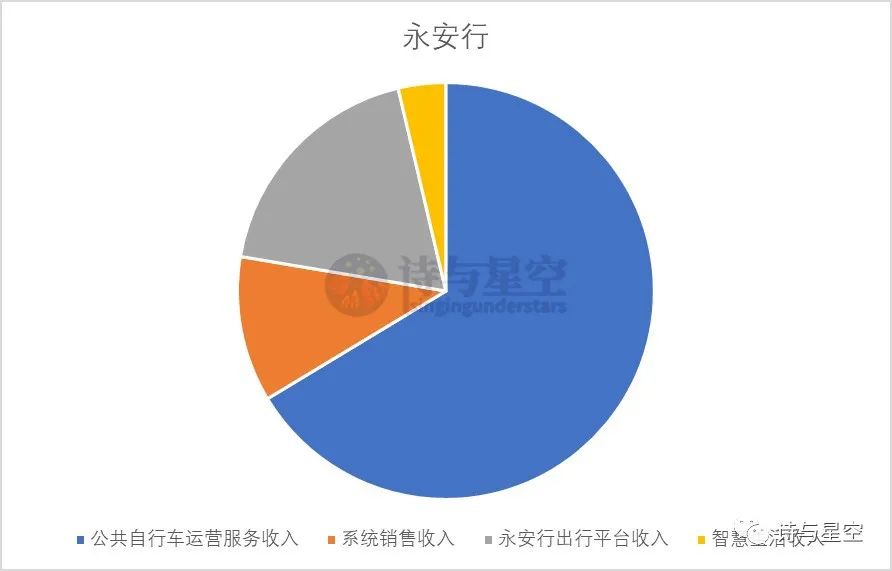

What kind of business is this? By 2021, the company’s revenue classification has changed again.

Data source: flush Ifind, drawing: Poetry and starry sky account for the largest proportion, becoming the “revenue from public bicycle operation and service”.

Originally, the company not only did bike sharing, but also provided platform services for the government’s bike sharing.

It made its own system into commercial software, sold it to some local governments and operated it on behalf of the government.

It turned out that when sharing bicycles did not make money, the company carried out the business of tog (government).

It has to be said that this is a very amazing business development.

Ofo falls too early.

Not only that, the company also cooperates with local governments to develop smart life service business for the elderly living alone.

It happened that XingKong Jun learned about similar businesses in an exchange with the doctoral advisor of Huawei University.

Smart electricity meters and smart water meters can monitor the water and electricity situation of families.

If the data of elderly people living alone are abnormal, they will be paid special attention.

02.

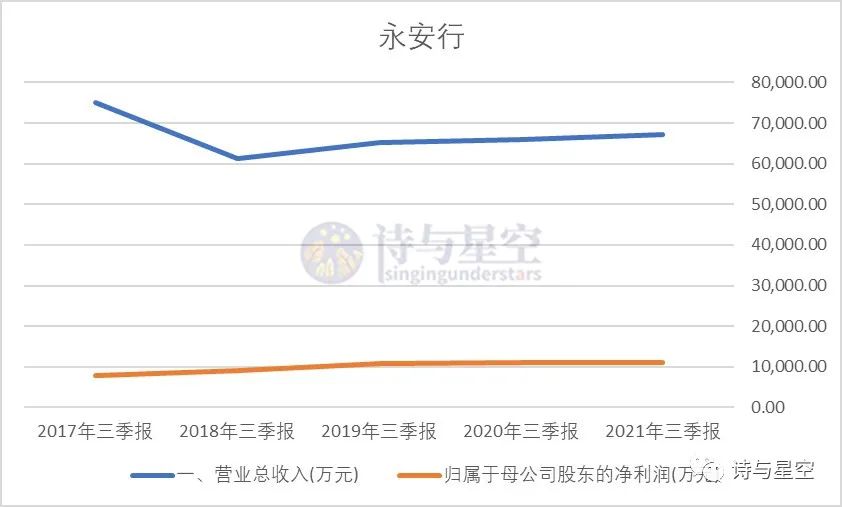

Looking forward to the annual report from the third quarterly report data source: flush Ifind, drawing: since 2015, the company’s performance has been very stable, with a revenue of about 700-800 million and a net profit of about 100 million.

The company’s businesses are relatively balanced and have little change.

In addition to the mediocre revenue, the cash flow statement shows that all the money earned by the company’s operation has gone to buy fixed assets.

The company’s fixed assets increased significantly, mainly bike sharing.

It can also be seen that the car sharing business has stopped developing for many years.

However, as we all know, the business of sharing bicycles is not about making money.

The biggest value of sharing bicycles is to bring WeChat and Alipay new life and promote life.

Even if it is strong as WeChat Alipay, because the formalities of card binding are very complicated, the cost of pulling new education is also very high.

But if young people start cycling from campus, they will have to bind the bank card with WeChat and Alipay, which will greatly improve the efficiency of pull new.

Before young people formally become high-frequency consumers, they are used to using WeChat Alipay for mobile payment.

Because of this, no matter how much money they share, there is always capital behind them.

According to Wang Xing, a good flag bearer should have the consciousness of being a pawn for others.

What do you think as a boss when you clearly know that you are a chess piece? Perhaps more enthusiastic is not the operation, but the capital operation.

03.

March hydrogen energy company introduced in the financial report: the main representative products include public bicycle system, shared power assisted bicycle system (lithium battery and hydrogen fuel), shared vehicle system (new energy), new generation public bicycle system and other shared travel platform services, as well as the sales and service business of smart life related products.

Among them, lithium battery and hydrogen fuel are easy to make people think.

XingKong Jun checked the company’s 2020 annual report and found that among its more than 30 subsidiaries, only one subsidiary of Anhui Yong’an low-carbon Environmental Protection Technology Co., Ltd.

has annual sales of more than 100 million.

According to enterprise investigation, the company has no relationship with new energy for half a cent, mainly in the R & D, production and sales of bicycle related fields.

Most of the remaining subsidiaries have annual sales of only a few million or even hundreds of thousands.

What do you rely on for hydrogen energy? As early as 2006, a hydrogen energy company called Shanghai panye was established.

In 2008, it produced hydrogen energy bicycles and provided services for the 2008 Spanish World Expo.

Why haven’t hydrogen powered bicycles been popularized for so many years? Or cost.

Many companies in France, Japan, Germany and other countries have produced hydrogen bicycles in China, and the cost remains high, equivalent to tens of thousands of yuan.

For more than ten years, there is no room for the cost of hydrogen powered bicycles to decline.

At the same time, the cost of hydrogenation station is also very high.

What are the competitors of hydrogen bicycle? a storage battery car.

Cheap and sufficient, why use hydrogen cars? In front of the battery car, the hydrogen bicycle has almost no power to parry.

Unless, for some ulterior purpose.

04.

Major shareholders the second largest shareholder of the company is Shanghai Yunxin Venture Capital Co., Ltd., an investment company with Alibaba background.

Through this company, Ali has invested in a large number of A-share listed companies..